michigan use tax license

Sales Tax Licenses are valid January through December of the current calendar year. Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax.

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

What transactions are generally subject to sales tax in Michigan.

. Businesses who sell tangible personal property in addition to providing labor or a service are required to obtain a sales tax license. Michigan Department of Treasury. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied.

If youd like to prepare your taxes yourself you can use the IRS Free File program. The procedure to get a sales tax permit Michigan is described. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into.

Theres no charge to register for a Michigan sales tax permit but other business registration fees may apply. In the state of. A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit.

Treasury is committed to protecting sensitive taxpayer. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a. Notice Regarding Changes to Prepaid Sales.

Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2. As of March 2019 the Michigan Department of Treasury offers. Michigan Sales Tax License Application Fee Turnaround Time and Renewal Info.

An online application is completed to the Michigan Department of Revenue web-site to get sales and use tax permit MI. Welcome to Michigan Treasury Online MTO. See Use Tax below for examples of transactions that may be subject to use tax.

This license will furnish a business with a unique Sales Tax Number otherwise. How do I obtain a sales tax license. SALES TAX RATE.

An on-time discount of 05 percent on the first 4 percent of the tax. This guide simplifies compliance with Michigans sales tax code by breaking down the process into four. MAXIMUM LOCAL COUNTY RATES.

This tax applies to the rental of tangible personal property to Michigan renters and to rental charges for overnight lodgings or accommodations. Minimum 6 maximum 15000 per. MTO is the Michigan Department of Treasurys web portal to many business taxes.

You must register for sales tax andor use tax on sales and rentals. Notice Regarding Michigan Taxes on Illegal Activities. The first step you need to take in order to get a resale certificate is to apply for a Michigan Sales Tax License.

You will need to pay an application fee when you apply for a Michigan Sales Tax License and you will. While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Examples of transactions which.

To register for Michigan business taxes you may either complete the online. This section applies to businesses that are applying for a license in Michigan for the first time. This type of permit also goes by several other names such as resale license sales tax permit sales and use tax permit wholesale license and reseller permit.

The sales and use tax permit Michigan is required to buy and sell taxable products and services within the state of Michigan. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. How long does it take to receive your Michigan sales tax.

Most businesses starting in Michigan selling a product or offering certain services will need to register for a sales tax license. A sales tax license is commonly referred to as a. What is the Michigan.

Use tax applies to the rental use of tangible personal property in the State of Michigan. It normally takes 2-3 business days before MI state issues a sales tax. Ad Catch Vendor Tax Errors Before They Are An Issue With Avalara Consumer Use.

Sales Use Tax Licensure. An application for a sales tax license may be obtained on our web site. In Michigan it is officially.

This page describes the taxability of. Use tax is a companion tax to sales tax. Any property which goes with the customer in connection.

How To Get A Business License In Michigan Truic

100 Free Michigan License Plate Lookup Get A Vehicle History Report

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Certificate Of Authority Foreign Michigan Corporation

Michigan Sales Tax Small Business Guide Truic

Cvdesigner1 Ilovedesign Graphic Design Resume Resume Design Creative Resume Design

Pin By Danielle Roy On Essentials In 2022 Tax Prep Social Security Card Drivers License

Realtor Classes Near Me Michigan Remax Jobs Realtor Classes Lansing Michigan Greater Lansing

How To Register For A Sales Tax Permit In Michigan Taxvalet

Credit Card Payment Form Template 41 Credit Card Authorization Forms Templates Ready To Free Business Card Templates Credit Card Free Printable Card Templates

Michigan Travel Pharmacist Any State License Welcomed Michigan Travel Pharmacist Funny Nurse Quotes

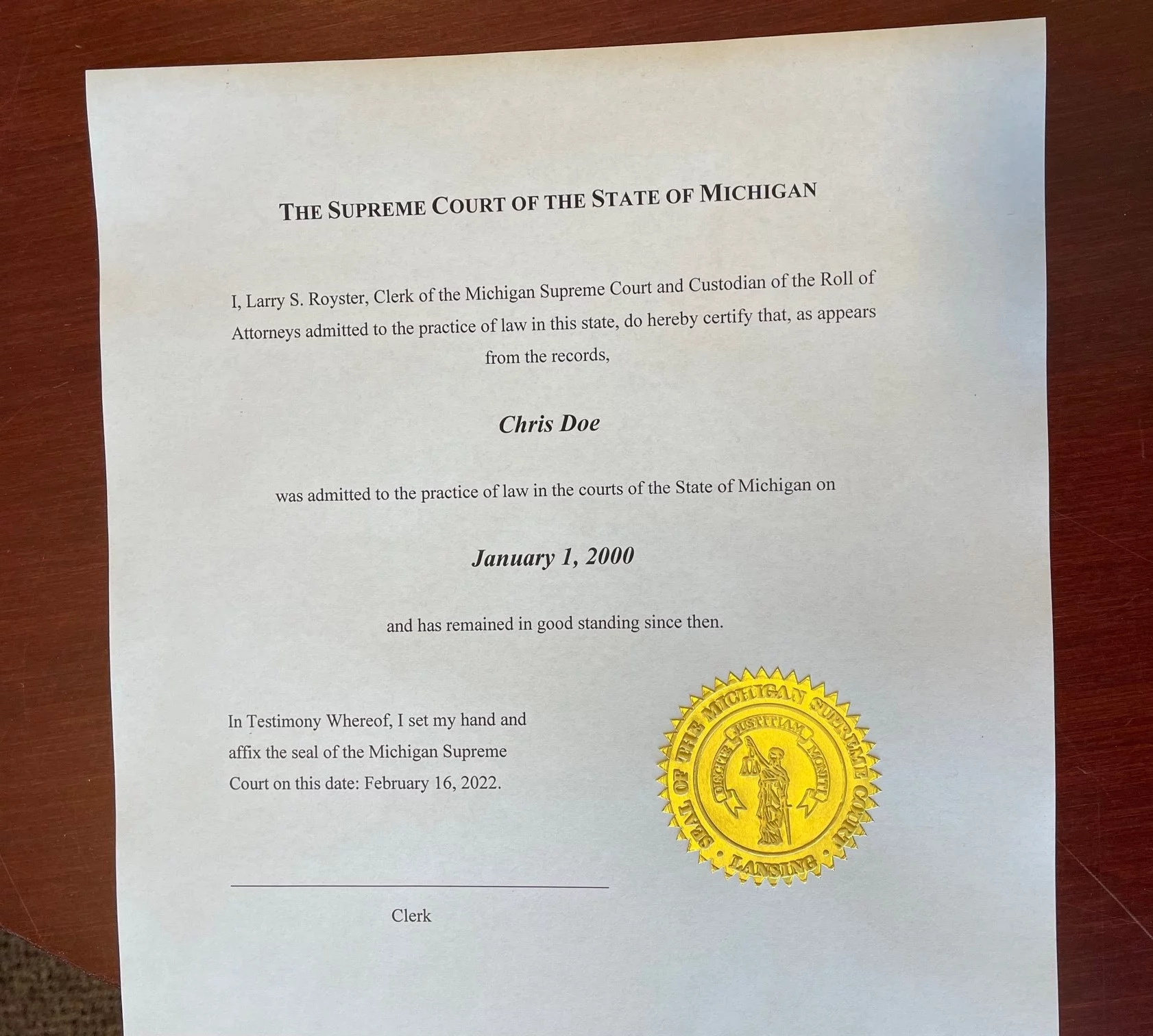

Attorney Certification Attorney Name Change

Harley Biker Quotes Biker Love Harley Davidson Dark Custom

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Sos Information For Mechanics Sos Mechanic